This Week’s Blogger: Scott D. Heins, CFP®, IAG Chief Investment Officer

If you made it past the title of this blog, congratulations! Most people likely saw “math” in the title and casually walked away without making eye contact.

Whether you like it or not, math runs your world. You can either choose to understand it or tolerate it, but you cannot live without encountering it – especially in the financial markets.

On June 15 the S&P 500 Index – a broad index of U.S. large cap stocks – sat precisely 23.55% below its all-time record high on January 3, 2022. While it has bounced back a bit since then, traders would say that the recent past has been more than a little rough. Investors wisely ask about the implications for the future.

While history is not a reliable predictor of future results, I am unable to locate any example in the history of the stock market where it declined significantly and then failed to eventually reach another record high at some point in the future. Therefore, it is highly unlikely (though technically possible) that January 3, 2022, will be the market’s record high forevermore.

What varies widely is how long the stock market takes to reach that new record high. The 2020 recovery following the COVID shutdown was remarkably fast. A record high occurred on February 19, 2020, the decline reached its nadir on March 23, and a new record high was set on August 18. It took just 6 months!

It took much longer during the Global Financial Crisis. A record high occurred on October 9, 2007, the decline reached its nadir on March 9, 2009, and a new record high was set on March 28, 2013. It took 5.5 years of patience and perseverance.

So what does market math imply about the future for investors? In my humble opinion, good news.

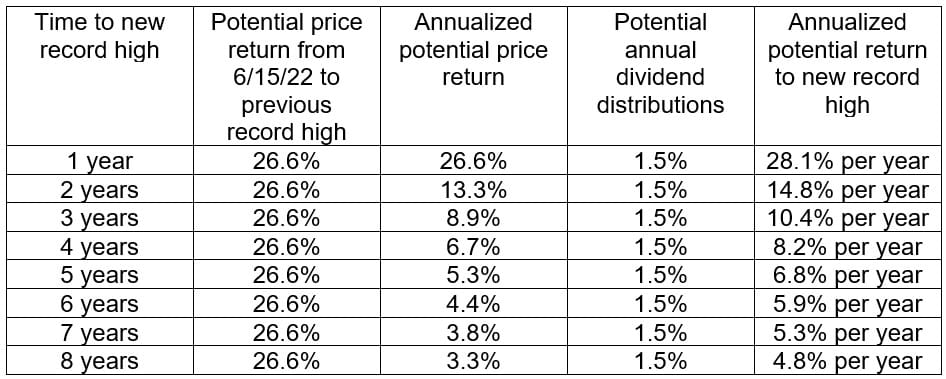

Here are the potential annualized returns from June 15, 2022, into the future IF the S&P 500 Index makes a new record high after specific periods of time:

Of course, none of this is guaranteed and the market could go even lower than its June 15 price at any time with no advanced notice.

However, this math does give us a reason for guarded optimism about the future if we have the patience and wisdom to casually walk away from the fears created by temporary market volatility without making eye contact.

Securities offered through LPL Financial. Member FINRA/SIPC. Investment advice offered through IAG Wealth Partners, LLC, (IAG) a registered investment advisor and separate entity from LPL Financial.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. One cannot invest directly in an index.

Any opinions are those of IAG and not necessarily those of LPL Financial. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. No strategy assures success or protects against loss. Investing involves risk including loss of principal.

LPL MMR 1-05302720

Quote of the week:

Warren Buffett: “When investing, pessimism is your friend, euphoria the enemy.”